Frequently Asked Questions

How will you tell me about the newest homes available?

The Multiple Listing Service Website provides up-to-date information for every home on the market. We constantly check the New on the Market list so we can be on the lookout for our clients. We will get you this information right away, the way that is most convenient for you: by phone or email.

Will you inform me of homes from all real estate companies or only EXIT Realty Home Partners?

We will keep you informed of all homes. We want to help you find your dream home, which means we need to stay on top of every home that’s available on the market.

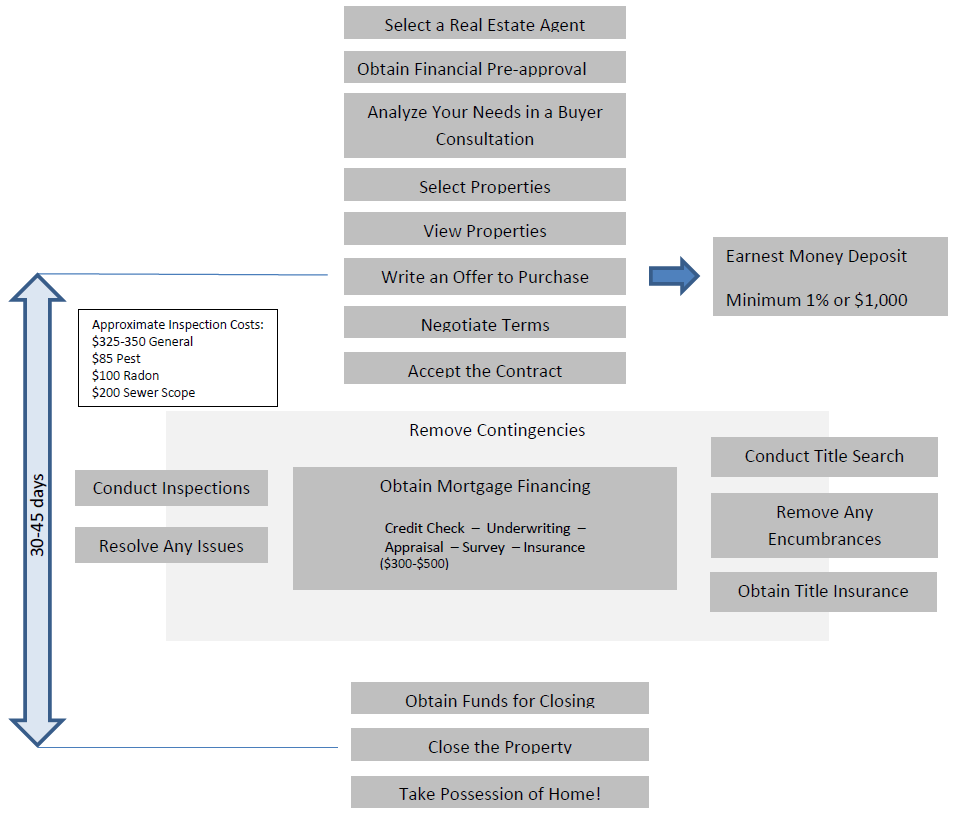

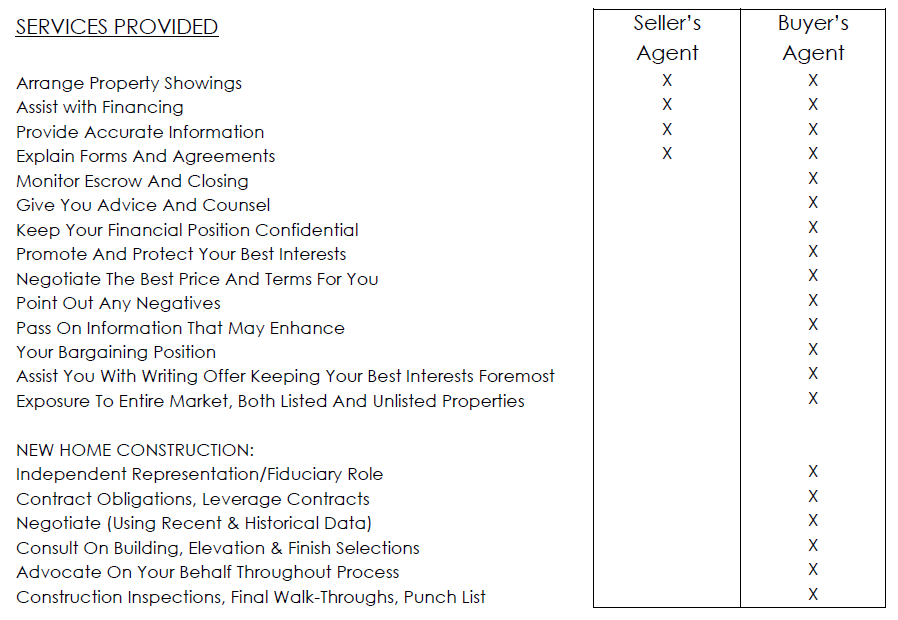

Can you help me find new construction homes?

Yes, we can work with most builders and get you the information you need to make a decision. On your first visit with the builder, we will accompany you. By using our services with a new construction home purchase, you will receive the services we offer, as well as those provided by the builder, at no additional cost.

How does for sale by owner (FSBO) work?

Homeowners trying to sell their home without agent representation are usually doing so in the hopes of saving the commission. If you see a FSBO and want the advantages of our services, let us contact the owner for you and make an appointment. Most times the homeowner will work with an agent even though their home is not listed, since the agent is introducing a potential buyer to their property.

Can we go back through our property again once an offer is made but before possession?

Usually, we can notify the seller and schedule a convenient time to visit the property again. Immediately before the closing, we will schedule a final walk-through and inspection of your new home.

Once my offer is accepted, what should I do?

Celebrate and focus on moving into your new home! You will want to schedule your move, pack items and notify businesses of your address change. We will provide you with a moving checklist to help you remember all the details. We will also give you a good faith estimate and HUD statement, which will indicate the amount you will need to bring to closing.